SMSF Life Insurance

Life insurance and self-managed superannuation funds

Life insurance has gone hand-in-hand with superannuation for many years. Most retail and industry funds offer an element of basic life cover as a built-in feature, and for an alarming proportion of Australians this is the only life insurance they have.

There are several advantages to holding your life insurance policies in your superannuation fund:

- The money in the fund can be used to pay the premiums, so you don't have to find any additional cash to pay for them. If you have an employer who makes compulsory contributions then this money will have been paid direct into your superfund, so you won't even miss it.

- Any contributions you make to your superfund are likely to be tax deductible, so anything paid for out of the fund is effectively bought tax-free. This means your insurance premiums can be 20 – 45% cheaper, depending on your tax rate.

- The superfund will also be able to claim a deduction for some types of insurance premiums, reducing the tax it has to pay on other income.

- There can be more tax advantages, especially for term life policies, when the superfund passes on the benefits to your financial dependents.

- Some funds (including some SMSF providers) have negotiated bulk discounts with insurance companies so you can get cover at better rates.

Other reasons to consider SMSF life insurance

If you have a Self-Managed Super Fund, then there are several other reasons to consider making at least some of your life insurance arrangements through your retirement fund:

- Since 2012 Australia has had rules which require SMSFs Trustee to consider life insurance as part of the fund's investment strategy and keep a written record of the decision including reasons for inclusion or exclusion of insurance. This doesn't mean life insurance is compulsory, the rule simply requires that Trustee consider and document an insurance strategy.

- There can be powerful additional tax advantages to holding your policies within an SMSF rather than an ordinary superfund.

- With the right structuring you or your dependents could end up with more money from an insurance payout than if you held the policy direct. Some insurers allow you to link policies held inside and outside your SMSF to give you the best possible benefits.

- It is becoming more and more common for people to borrow within an SMSF, for example a mortgage on an investment property. Taking out life cover can be essential to ensure the fund can repay the loan if you die or are unable to work and make contributions.

The importance of seeking professional advice

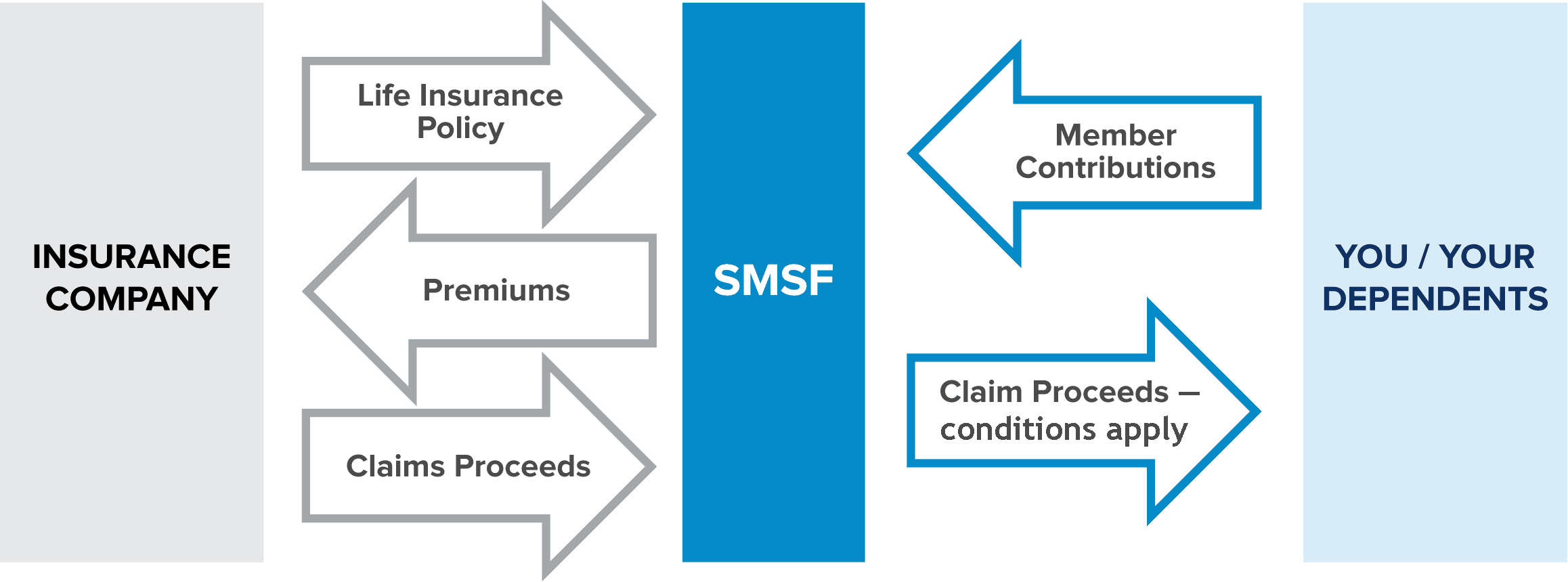

Here's an overview of how life insurance works with your SMSF:

When taking out insurance through a Self-Managed Super Fund, the fund will be the effective owner of the policy, rather than the individual. Superannuation rules mean that the Trustee will only be able to release money, including proceeds of a claim, if you meet terms of release conditions, which could leave you unable to access the cash when you most need it.

There can be some serious implications to holding your insurance within your SMSF so it's vital to plan ahead and get expert advice from your accountant or financial advisor on how to set up your policies.